I really don't have a lot of time to place to a journal, but I believed that if I'm sitting and assessing charts, I could too make notes of what I am doing, in hopes that I will keep growing into a much better trader. The overall concept here is to evaluate the prior weeks weekly pub and use a trading direction to be determined by it to the following week. After that, wait from the direction that it was decided to exchange in for great set-ups.

I will start with this EurUsd. According to last weeks weekly near, I am seeking to make short trades on the pair just. I'm thinking that around 1.1075 could be a good place to begin looking for short set-ups. I will look for candlestick formations/chart formations/consolidation breakout formations from the direction that I'm looking to trade.

I was able to earn some nice pips short on Friday and just wish that I was still in the trade. This approach with this particular journal will hopefully help in my conclusions. And, against a more powerful management, although allow me to stay out of transactions that might be. We are going to see. I should have pair ideas to come using thoughts and this method.

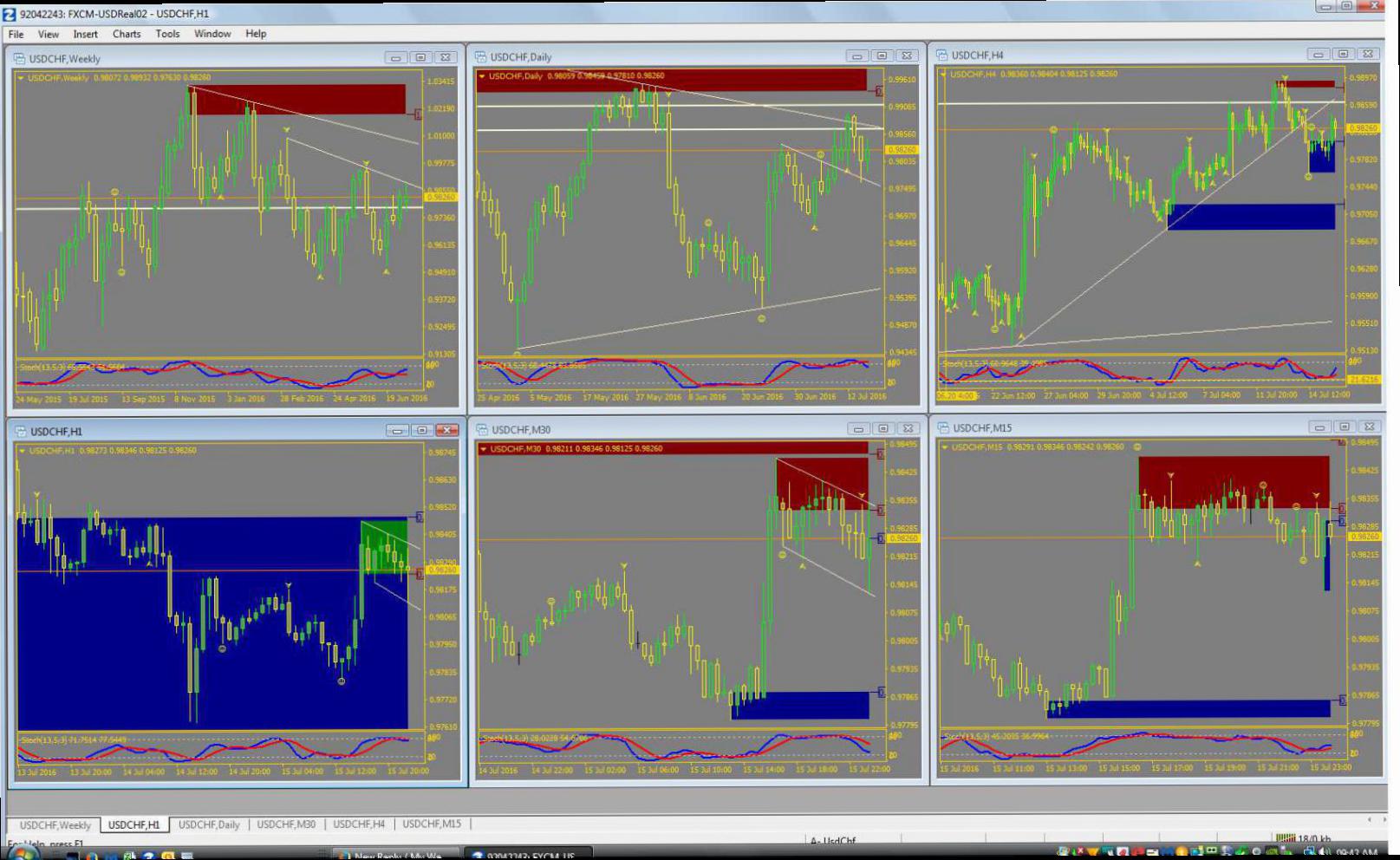

This is exactly what my EurUsd work space looks like:

Reply With Quote

Reply With Quote