Hi traders

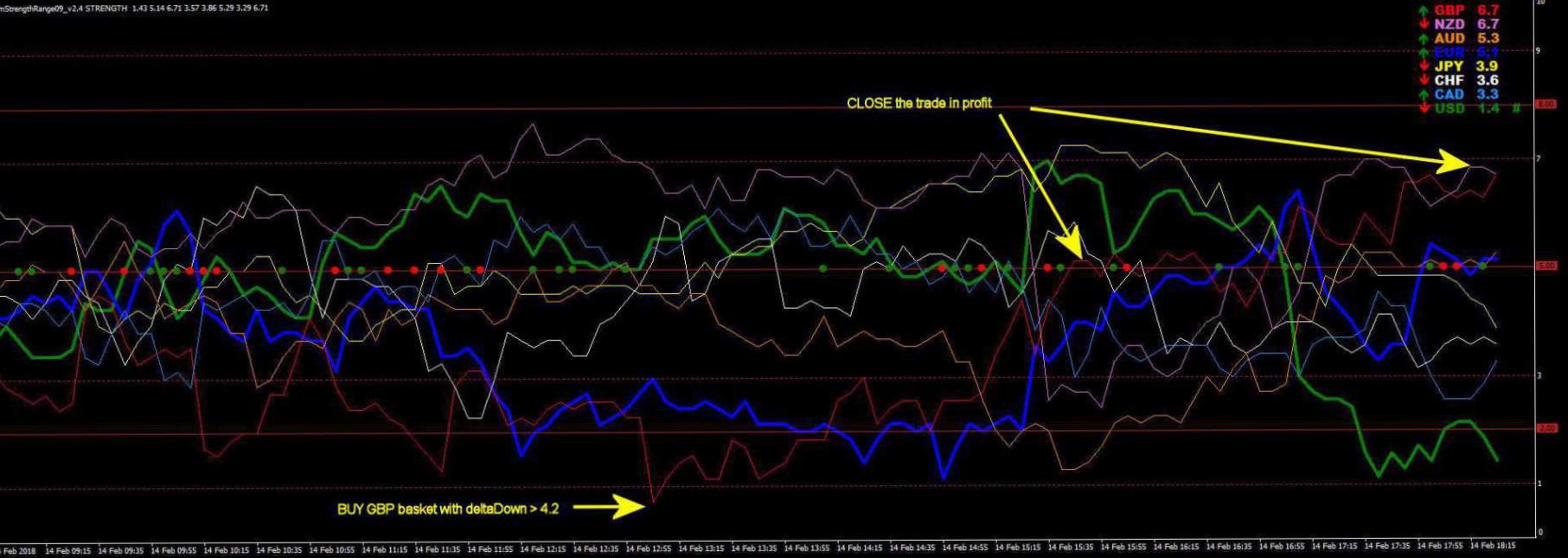

On the picture # post 2, we can observe the movements of the 8 currencies during a session. The main methods to exchange are to wait for a cross of 2 currencies and to take position in the fantastic direction. Unfortunately I have not had good results because after a cross frequently happens a cross in another direction. So I have tried another method thinking that when a currency is very strong (or weak) in comparison to others, its movement is over or almost. However, I needed a fantastic indior to compare the strenght ( or the weakness ) of this currency compared to others. Ezios left it. . .thank you.

This indior altered by Ezios displays 2 important parameters: DeltaUp and DeltaDown.

Explanation:

Currency in 1 st position; Value of Upper Currency (VUC)

Currency in 8 st position: Value of Lower Currency (VLC)

Average of this 7 Others Currencies: ( A7OC )

Calculation: DeltaUp = VUC - A7OC and DeltaDown = A7OC-VLC.

You understand how is calculated that the strenght or the weakness compared to the 7 others currencies.

Example:

On the picture # post 3, the upper currency is USD with 7.0.

The average of the 7 others is ( 6.6 5.9 5.1 3.7 3.1 3.1 1.4)/7 = 4.1

So the DeltaUp is 7.0 - 4.1 = 2.9....same calculation for DeltaDown.

More the Delta is high more the probability of return of their currency to others is great.

Practice:

I live in France... therefore the London session is Ideal for me. . .30 mn before available till NY open. . .sometimes afterwards

I put delta = 4.4. As soon as the DeltaUp or the DeltaDown reaches the value, the indior displays the order.

If DeltaUp gt; 4.4, we market Upper Currency basket. In case DeltaDown gt; 4.4, we buy Lower Currency basket.

To activate the orders, there are lots of tools. I use Dashboard Power Meter V3 cust_Curr.

Sometimes at the beginning the market is moving against us. I activate an additional order at delta = 4.8 and yet another at 5.2.

Of course, a SL is an absolute need.

It's possible to observe another indiion on the indior... Delta 1/8.

Delta 1/8 is the calculation of the upper currency versus the lower. The fantastic value of Delta 1/8 is higher.

In this case, the indior displays the order. So you can trade just the pair and not the basket.

Close:

Depending your trading style. I am waiting to get a position of this currency in middle of board ( position 4 or 5 ) to shut the transactions.

I suggest strongly too the use of a lock appliion to protect your gain ( see post # 39 )

Currently Ezios and faryne are working in an EA to automate the transactions with the same cause as the indior and 3 levels of delta.

For instance with USD upper currency 1 st market USD basket in 4.4... 2 nd market USD basket at 4.8 3rd market USD basket in 5.2.

Of course, the levels of delta could be put by the trader according his trading design ( spacing out the deltas through the intervals of volatility )

If some coders wish to work with us, they are welcome to enhance Gabin System.

Warning

This thread is just for eduion purpose and you've got not to go to account.

Gabin System is a countertrend system utilized to ch a reversal currency transfer.

So it's risky particularly during the periods of volatility.

The provided tools within this thread will also be for testing and have not to be utilized in actual account.

But if you understand the logic and utilize Gabin System along with your brain preventing news, with good settings, a correct SL and a lock appliion, you can make some good pips regularly.

Enjoy it.

Many thanks particularly for Ezios, faryne and gvc, the creator of the dashboard below.

Do not forget to leave your appreciation about the survey over

https://www.nigeriaforextrading.com/...1368065327.ex4

https://www.nigeriaforextrading.com/...5125657540.mq4

Reply With Quote

Reply With Quote

!

!