GBP/USD M1 ObservationsOriginally Posted by ;

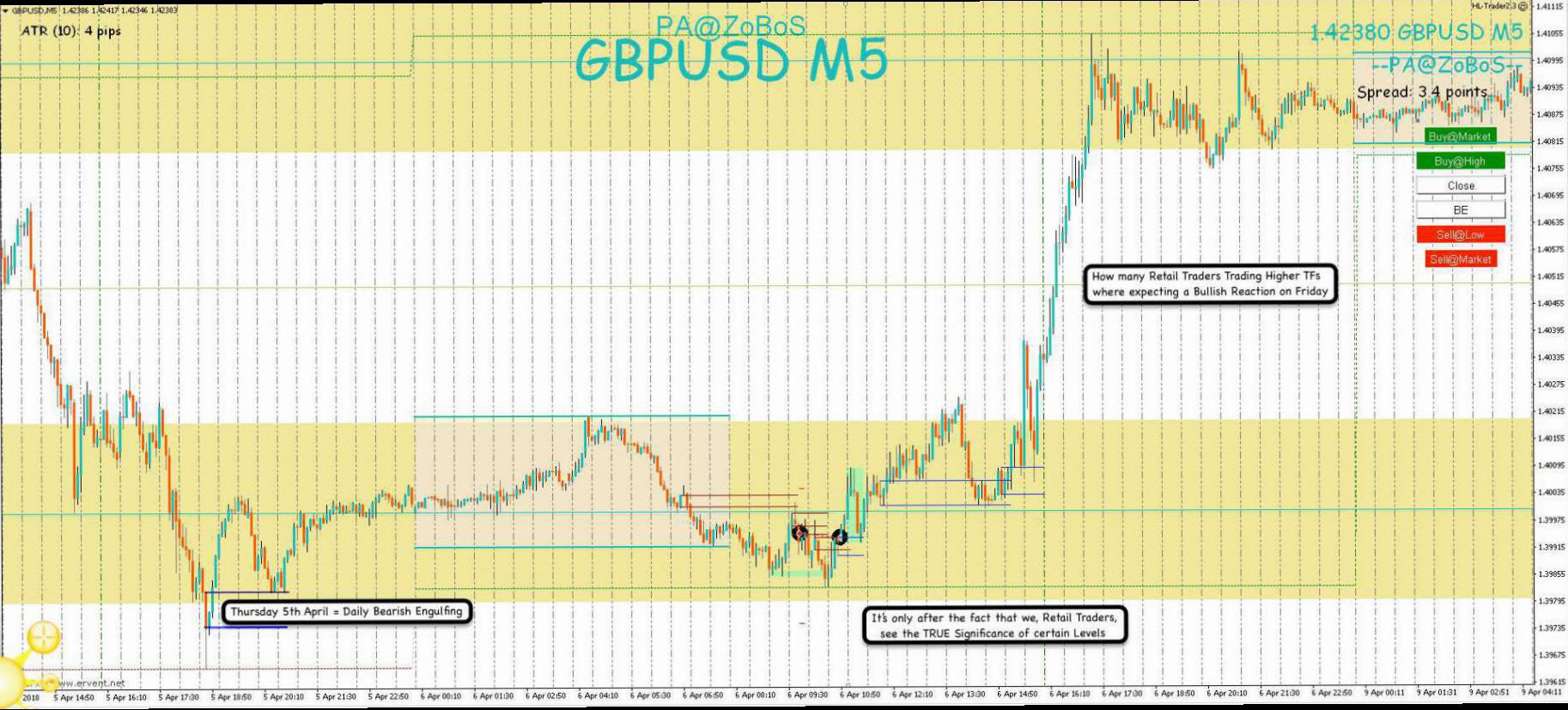

Waiting to see if there are Sufficient Sellers to Break through This Degree of Buying.

Everything is relative to the Time Frame being Traded within a Greater Time Frame this Level of Buying would be insignificant.

Reply With Quote

Reply With Quote